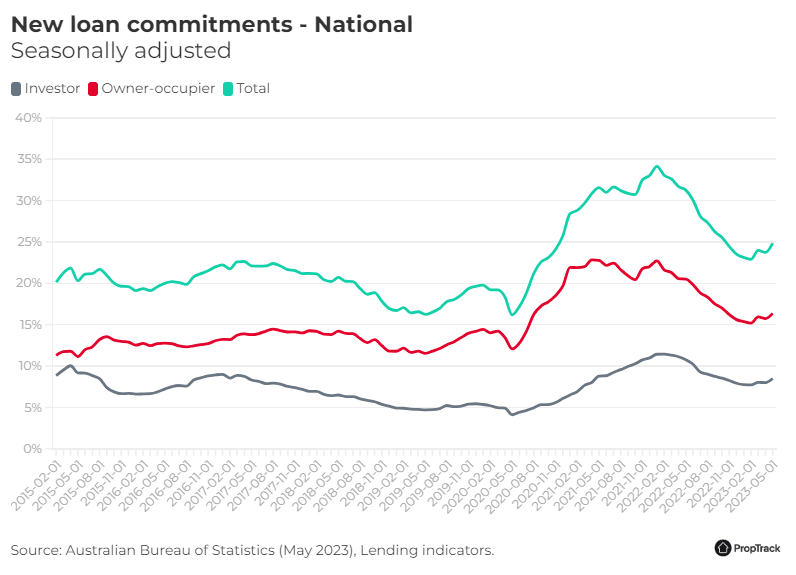

New loan commitments increased by 4.8% in May 2023 to $25 billion, signalling property buyers are becoming increasingly active even after 12 interest rate rises since May 2022.

Investor lending picked up the most, with a 6.2% increase, while owner-occupier lending rose by 4%.

This puts new lending volumes 45% above the recent low in June 2020, when it dropped to $17 billion.

New lending is up as property buyers become more active. Source: Getty Images.

New commitment volumes will unlikely return to the highs of 2021, when rates were at historic lows, in the near term. However, lending has been steady since late last year, and the recent increases in May and March indicate that property seekers are willing to enter the market despite high lending rates.

It is also important to note that the number of new commitments and the total dollar amount are higher than pre-pandemic levels (February 2020). Total loan dollar amounts are $5.6 billion higher – a 29% increase.

First-home buyer and investor loans lift

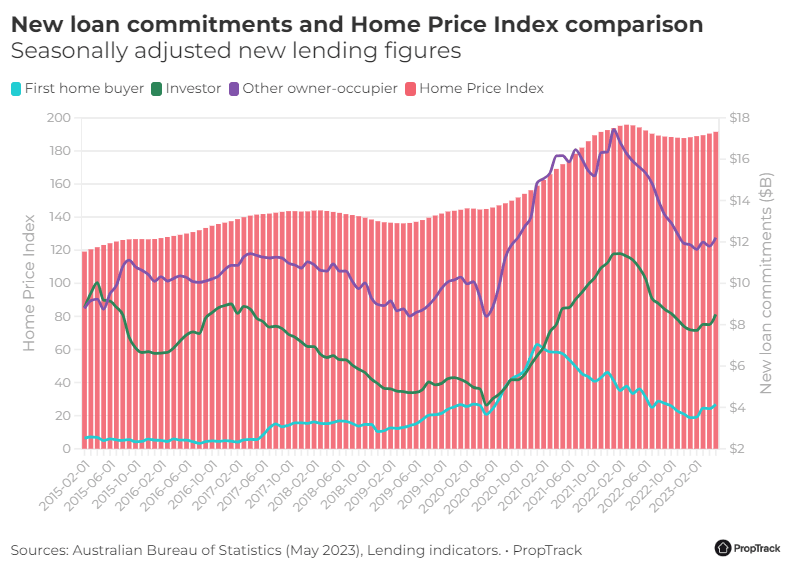

First-home buyers have begun to return to the market, with $1.4 billion written in loans in May – a 5.5% month-on-month increase. Lending to first-home buyers peaked in January 2021 when $7 billion of new loan commitments were approved.

However, first-timers began dropping out of the market earlier than investors and other owner-occupiers as prices skyrocketed.

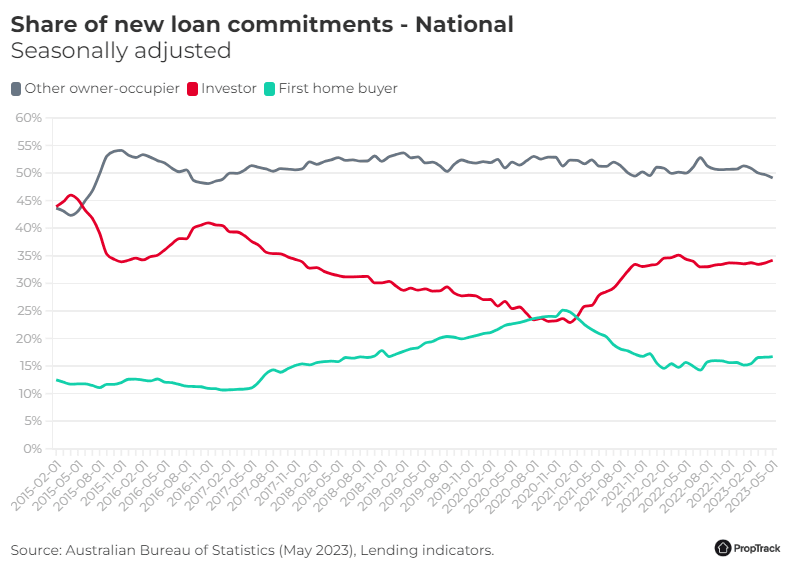

In December 2020, new commitments for first-home buyers made up 25% of all loan approvals, higher than those from investors.

However, comparing the PropTrack Home Price Index with the loan commitments for each buyer type, it is evident that first-home buyers began reducing only ten months into the pandemic, when prices began rising by approximately 2% per month.

This is a clear sign that prices have become out of reach for many trying to buy their first home.

Both investors and other owner-occupiers continued to borrow during 2021 but slowed down in the lead-up to the first interest rate rise.

First-home buyers overtook investors for share of new lending in mid-2021 thanks to the popularity of the HomeBuilder Grant and record-low borrowing costs. However, as soon as the grant period ended, there was a drop in first-home buyer loans.

Property prices were also rising at record speeds, making it hard for first-home buyers to afford a property, even with extremely low-interest rates.

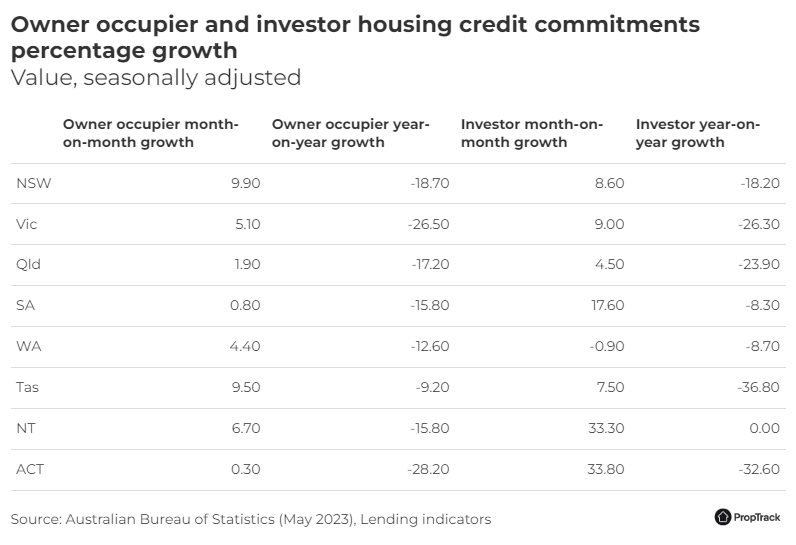

New loan owner occupier and investor commitments by state

The largest month-on-month increase in owner-occupier new lending by state comes from New South Wales (NSW) and Tasmania (TAS), which both recorded more than 9% growth.

The largest increase in investor new lending was in the Australian Capital Territory (ACT), the Northern Territory (NT), and South Australia (SA) – all recorded significant month-on-month growth.

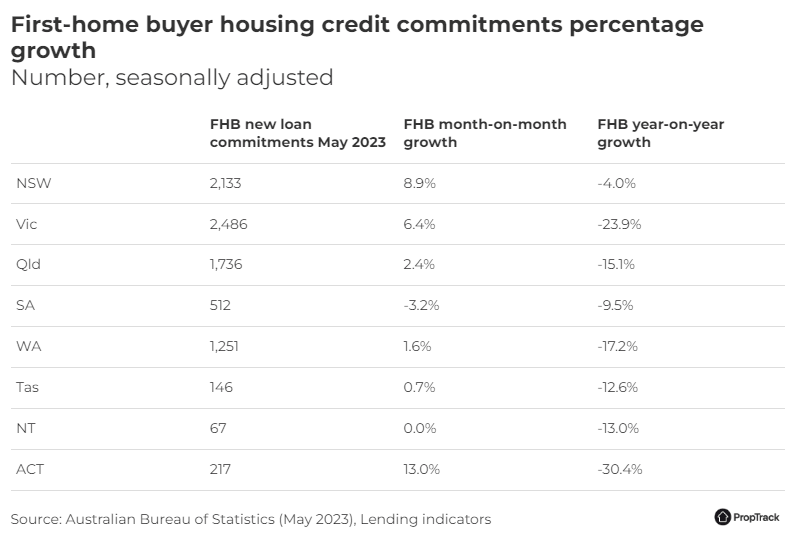

First-home buyer new loan commitments by state

The number of new lending commitments for first-home buyers is increasing, particularly in ACT, NSW, and VIC.

New loan commitments in Canberra increased by 13% month-on-month, which is significant given the median house price in Canberra is the second highest in the country.

First-home buyer and investor hotspots

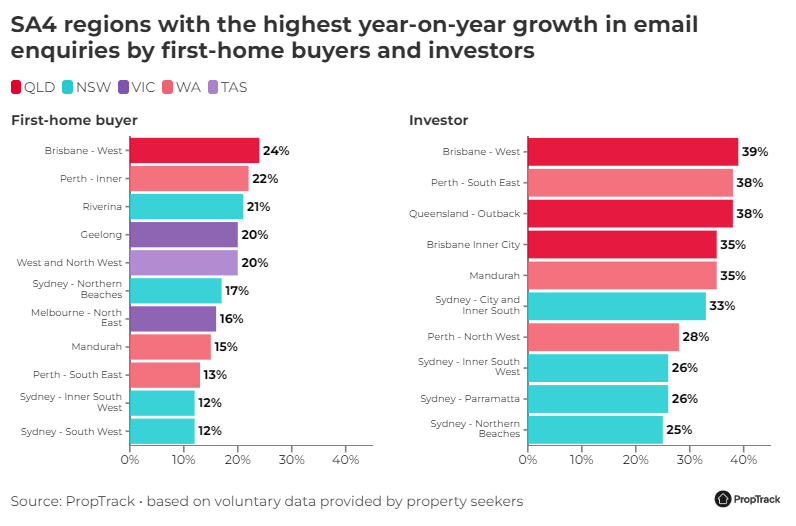

Enquiry data from realestate.com.au reveals where first-home buyer and investor demand are most concentrated across Australia.

Although demand from these buyer types is still much lower than last year, there are many regions where enquiries were up in June 2023.

Sydney and Perth regions have seen the highest year-on-year growth for enquiries, although Brisbane – West takes the top spot for both buyer types for the largest growth.

Indooroopilly is particularly popular with first-home buyers, as it is close to The University of Queensland, the CBD, and other amenities.

Brisbane is a hotspot with both first-home buyers and investors. Source: Getty Images.

Looking ahead

Buyer interest is increasing with home prices on the rebound and a pause in rate rises this month.

The new loan commitment data shows that there is demand for properties, despite the higher home loan rates and low available stock.

We are also seeing these improvements during the winter months when the market is seasonally quiet, which bodes well for a strong spring selling season.

Source: realestate.com.au